Mission-Ready Payroll for Your Business

Join the ranks of businesses that trust OnlinePayroll.Services (formerly TruPayroll) for their payroll needs.

Trusted by companies all over the world

Mission Objectives

At OPS – OnlinePayroll.Services – our objective is clear: deliver uncompromising control, confidence, and continuity to business owners through precision payroll operations. We empower you to take command of your workforce with a platform engineered for performance, resilience, and clarity.

- Real-time Communication

- Executed with Pinpoint Accuracy

- Vigilant, Protected, and Mission-ready

- Strength through Structure

What We Do

We deliver mission-critical payroll operations with elite precision.

At OnlinePayroll.Services, we don’t just run payroll — we execute it like a special operation. Behind every paycheck is a silent system of accuracy, security, and timing you can trust. We’re not a platform. We’re your tactical partner in the field.

Why OPS

Its not just payroll. It’s full-spectrum operational control.

Payroll Deployment

- Seamless, on-time payroll processing for every pay cycle.

- Direct deposit execution and secure paycheck delivery.

Tax Filing & Payments

- Federal, state, and local taxes filed without delay.

- Backed by compliance protocols — no guesswork, no gaps.

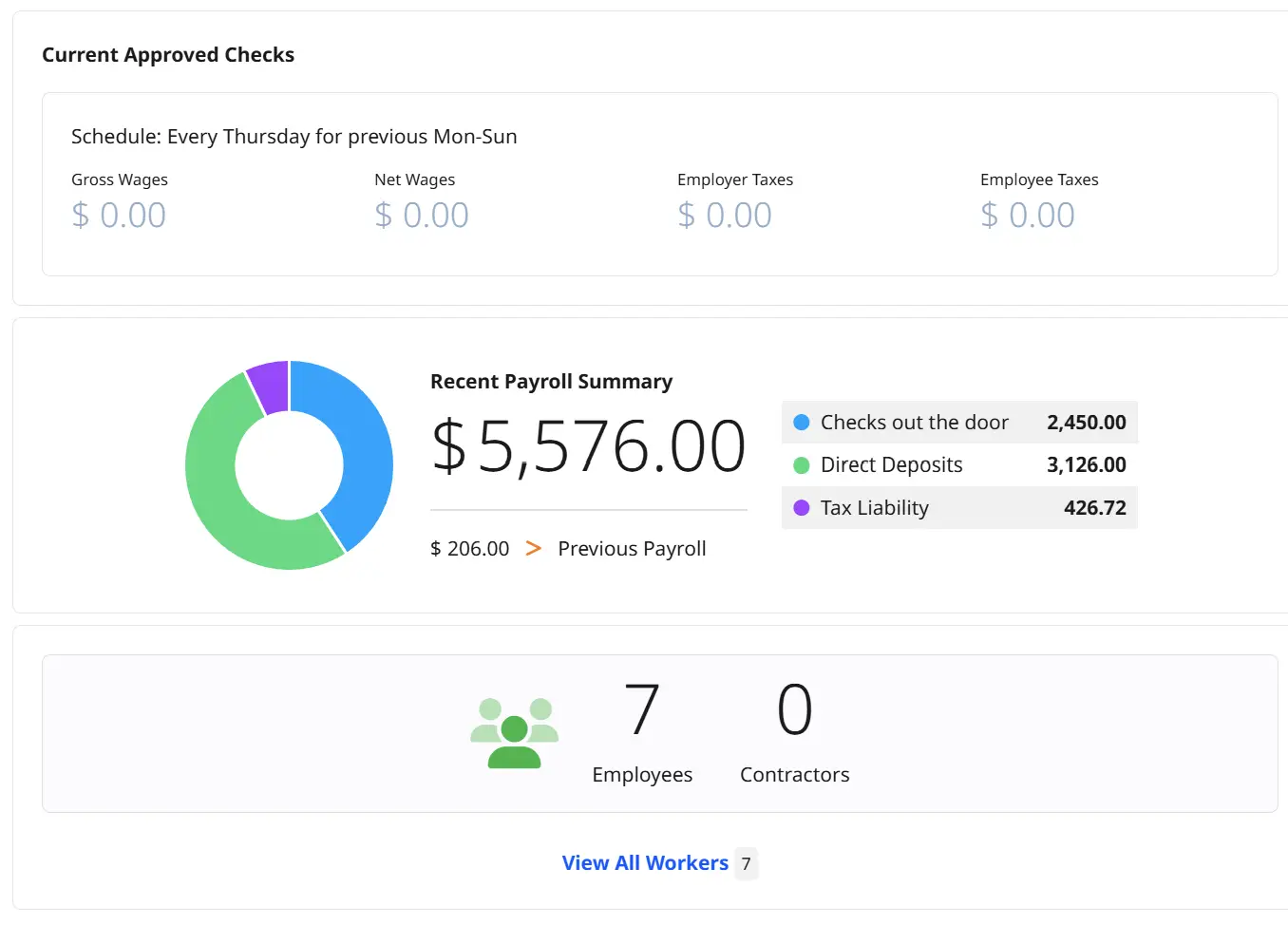

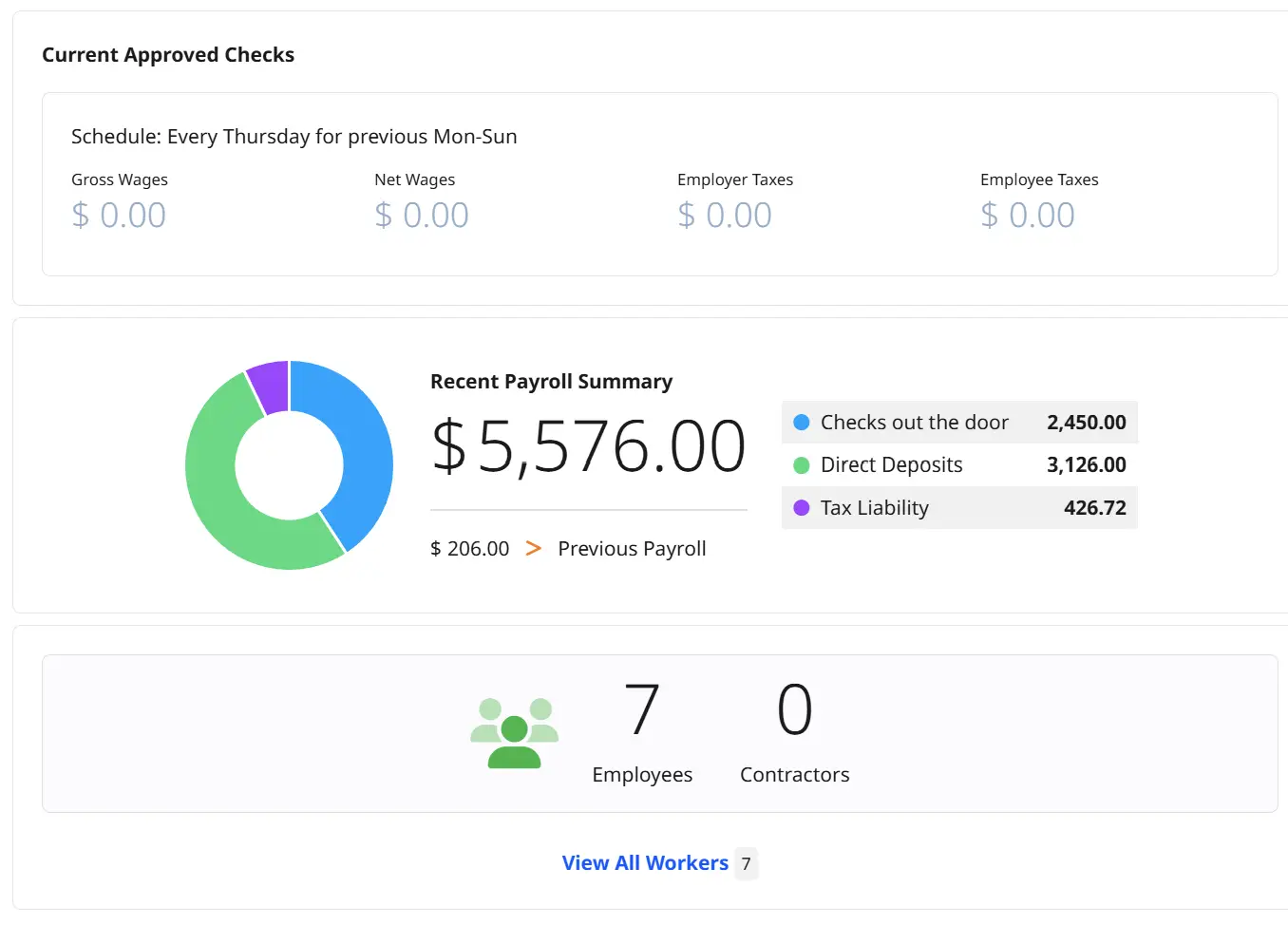

Reports & Recon

- Real-time payroll intel when you need it.

- Clean, exportable reports for every mission (payroll summaries, tax liabilities, audits).

Secure Command Access

- Admin-level access to key payroll functions.

- Data protected behind military-grade encryption and account-level control.

How It Works

Simple. Secure. Mission-ready.

We’ve stripped the complexity out of payroll. In just three steps, your operation is fully deployed — no training required.

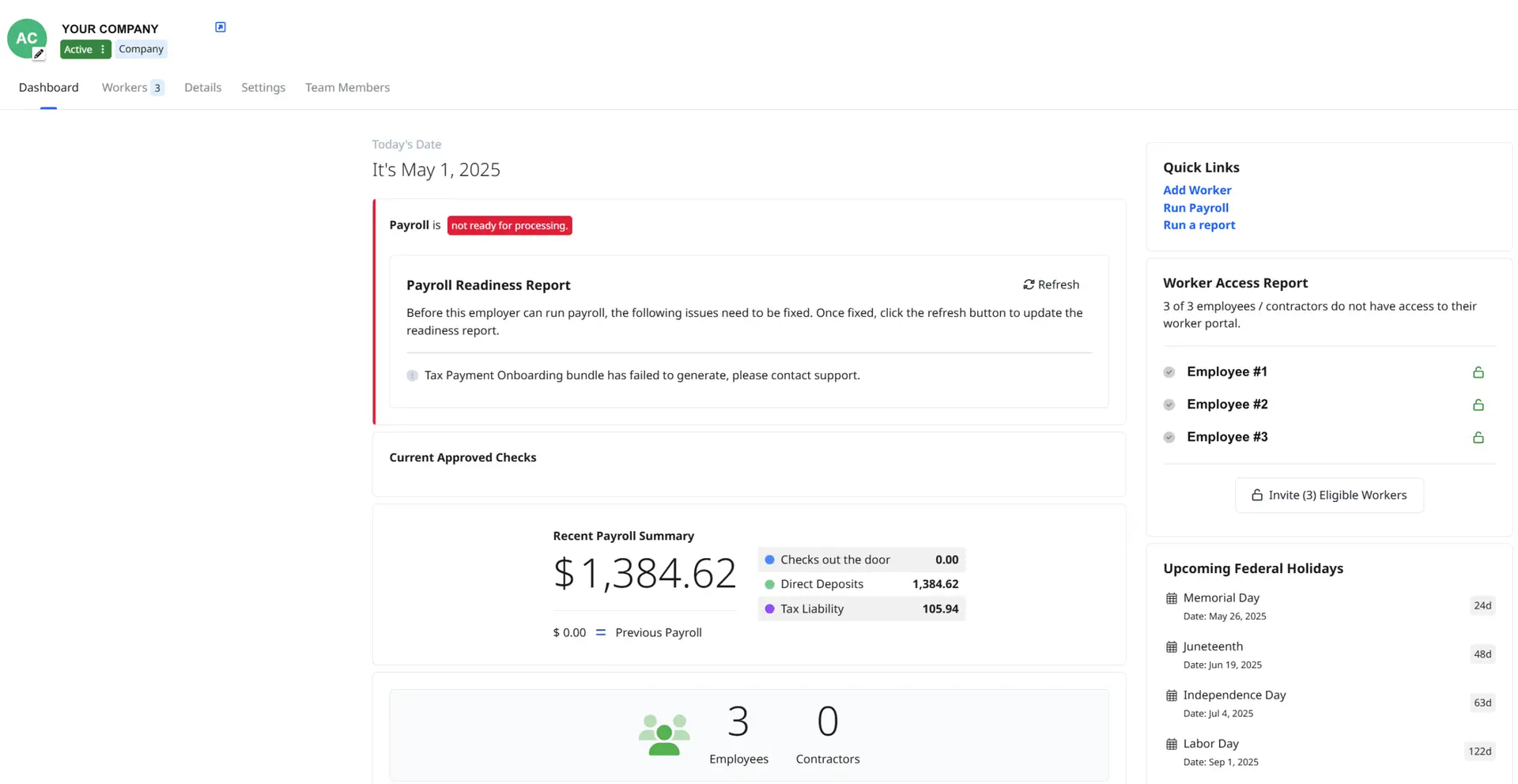

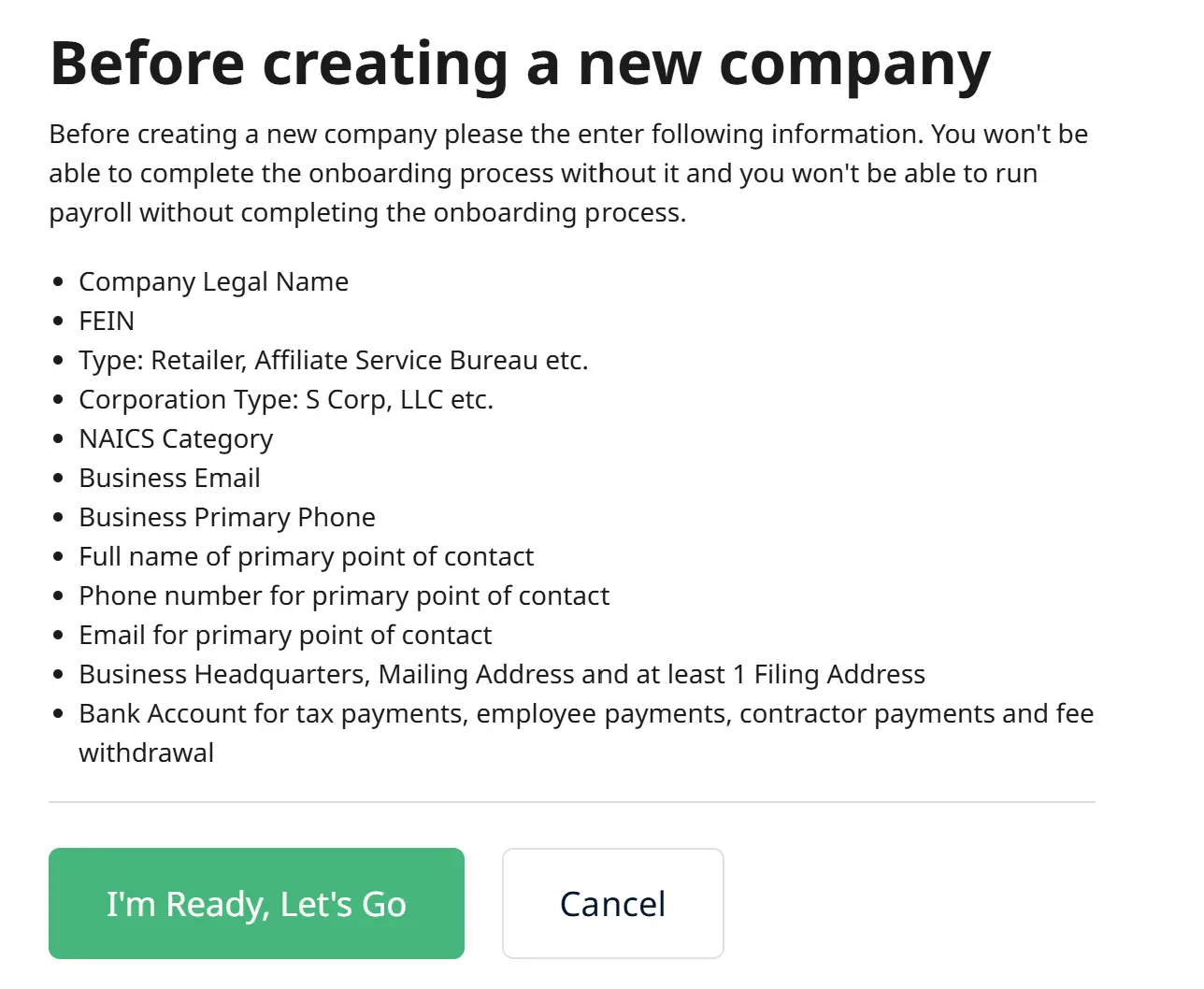

🛰️ Step 1: BRIEF THE MISSION

You onboard your company. We handle the prep.

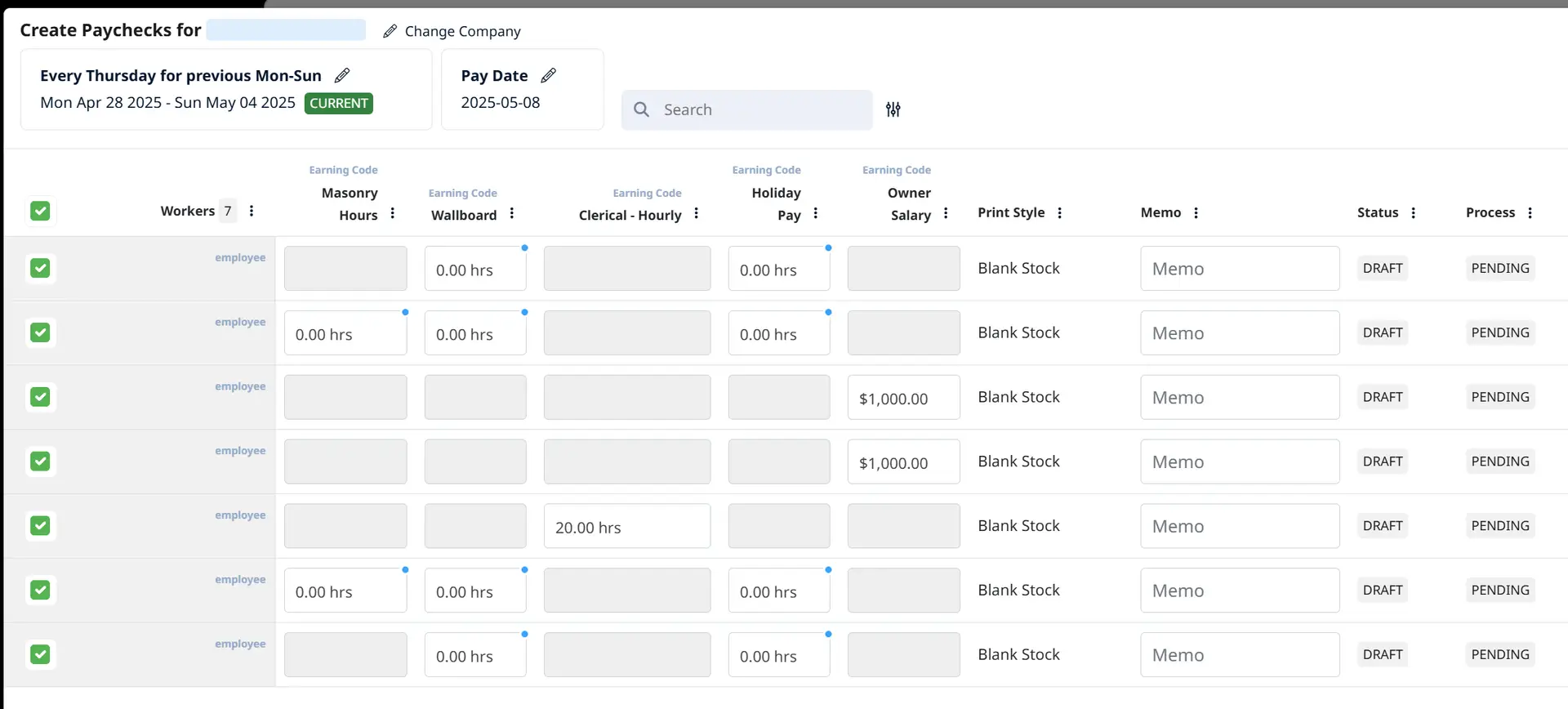

We’ll gather key intel — employee info, pay schedules, tax settings — and configure your payroll command center.🚀 Step 2: LAUNCH THE OPS

Run payroll with a single, secure action.

Whether it’s salaried, hourly, bonuses or reimbursements — our system executes the operation with precision and zero delay.🔐 Step 3: LOCK IT DOWN

Tax filings, reports, and deposits — fully handled.

We automatically file and pay your taxes, issue direct deposits, and log every detail in secure, export-ready reports.

Your role? Confirm and command. We handle the rest.

Deploy. Execute. Complete.

Payroll isn’t just a process — it’s an operation.

Each phase is executed with military-grade precision, from initial setup to tax filing and direct deposit delivery. Below, we break down how every step in the mission is designed to maximize control, eliminate risk, and keep your team paid without compromise.

Create Your Command Profile

You’ll establish your account with encrypted credentials, define your company’s command structure, and gain access to your payroll operations hub — no paperwork, no lag, fully online.

Assemble Your Unit

From squad to battalion, we make it easy to enlist your workforce.

Using WorkflowPro, you’ll securely add each team member — whether you’ve got one operator or a full platoon. Assign roles, define pay types, and deploy your people with total clarity.

Commence Payroll Ops

Initiate your first payroll, automate filings, and let the system carry out every objective — direct deposits, tax payments, and reporting — all under your watch, with zero friction.

Mission-Ready on Any Device

Whether you’re at HQ or in the field, your payroll command center is fully operational on desktop, tablet, and mobile — no app required. As a fully web-based system, you can deploy, approve, and command from anywhere with nothing but a browser.

Key Features

These aren’t just features — they’re mission-critical systems.

Each tool in the OPS Loadout is engineered for precision, automation, and total control. From secure communications to real-time recon, every function is designed to execute flawlessly under pressure and keep your payroll operation locked in.

Real-Time Recon

Get instant access to payroll reports, tax liabilities, and deposit confirmations — all in one secure dashboard.

Encrypted Comms Channel

Receive system alerts, confirmations, and payroll updates with encrypted email and SMS options built for high-trust operations.

Smart Targeting Logic

Built-in automation handles taxes, recurring pay, and compliance — so you never miss a beat or deadline.

Command-Level Access

Assign roles and permissions to operators on your team. Maintain control over what’s seen, changed, or approved.

Zero-Drag Interface

Web-based, intuitive design built for speed and clarity. No apps, no installations, just launch and operate.

Autopilot Filing Protocol

Federal, state, and local taxes filed on time — every time — backed by precision automation and compliance logic.

The Backbone of seamless operations

Behind every flawless payroll execution is a system built for scale, speed, and control. Our platform connects compliance, calculations, and deposits into one mission-synced workflow — no gaps, no delays. Powered by automation and driven by precision, this is the infrastructure that keeps your operations seamless, whether you’re processing for one squad or an entire battalion.

$291

The average cost per payroll error

45%

Small businesses in the US that outsource payroll

14M+

American businesses use a payroll platform

$845

The average annual IRS penalty per year for SMB's